Gone are the days when buying a used car was just a plan B for people planning to purchase a car. The future of the used car market has only broadened its horizons over the past few years but showed 360-degree changes in all forms – the shift in search and purchase methods, increasing preferences for user-generated content and digital-first purchasing solutions, the growing concerns about the environment, financing options, add-on services, dealership services, and much more.

Did you know that the worldwide used car market will reach USD 2.67 trillion by 2030? (PRNewswire) And that it will expand at a CAGR of 6.1% from 2022 to 2030. Numerous opportunities, drivers, trends, and challenges will navigate the future of the car dealership landscape. This blog will cover all these nuances in great detail. Let’s dive in.

What is the Future of Used Car Market?

The future of used car market will be a roller-coaster adventure. Starting from technology, the rising tech advancements will pave the way for surged demand for used cars. Moreover, the ever-increasing use of AI and other digital functionalities will continue to do a makeover of the online buying experience and play pivotal roles in the future of automotive industry. Besides, drivers like improved transparency between owners and buyers, and the introduction of certified used vehicle programs may bring in some positive transformations in future car dealerships.

There has been a noticeable trend in the last few years with regard to the growing adoption of used electric and hybrid cars. The market is now experiencing the direct impact of the increased number of new Electric Vehicles (EVs) and hybrid cars that have been registered in recent years.

Online sales channels have been one of the major drivers of used car consumption. While online automotive retailing currently represents a small proportion of total used car sales, this segment possesses substantial growth potential. Automotive dealers have started prioritizing building omnichannel dealerships. They are now revamping their websites for sales and marketing, directing potential buyers to physical showrooms to complete the purchase process.

However, present-day consumers seek eCommerce options for their entire purchasing journey. Besides, the market demand is experiencing traction due to the escalating investment in the SUV segment. Luxury brands are actively investing in launching vehicles in the SUV segment to expand their existing sports collection inventory. This investment is expected to drive significant volume sales in the market, coupled with increased availability of a well-established supply chain network for second-hand cars.

Key Highlights for the Future of Used Car Market

- Digitally generated leads with online sales channels will gain traction, while brick-and-mortar/offline dealerships are projected to remain under severe pressure due to the COVID-19 outbreak.

- The organized dealership will withstand the demand for used cars and ultimately secure a significant share of the market.

- Data analytics tools and AI will enable non-banking financial companies to enhance the effectiveness of the underwriting process. Used car dealers, recognizing this opportunity, are forming partnerships with financial agencies, facilitating the availability of loans to customers in a more streamlined manner.

- The Asia Pacific region will see a surge in growth in the segment throughout the forecast period, primarily driven by the expanding supply base and rising demand for affordable used cars.

Global Used Car Market Industry Trends: Analysis and Forecast

The growing disposable income of working individuals is basically seen as propelling market growth. This enables consumers to purchase vehicles within a limited budget. In contrast, high-income households saw a 6.4% reduction followed by a 3.9% increase over the same period. These used car market trends show a substantial growth in the used car market in recent years which can be attributed to the cost competitiveness among new market players and the inability of a significant portion of customers to afford a new car.

Besides, According to data from Data Bridge Industry Research, the value of the global used-car industry was estimated to be USD 996,906.42 million in 2022 and will increase to USD 1,700,106.13 million by 2030. Moreover, the demand for pre-owned vehicles has seen massive growth in recent years, driven by the competitive pricing offered by new players, effective used car dealership marketing strategies, and the inability of a large portion of customers to purchase a new car.

Here’s a quick used car market forecast 2024 of industry drivers for the future of used car market:

Opportunities

Rising presence of multiple car manufacturers and used vehicle dealers

To help the regional automotive sector improve and maintain its tech leadership globally, the European Commission actively promotes global technology standardization and provides funding for R&D initiatives. Used vehicle dealerships in the area are, thus, offering a variety of digital-first options for tracking automotive performance, including smartphone applications and virtual online outlets.

Growing e-commerce and Online Sales

Technological advancements in the telecom sector have enhanced internet connectivity, while the increasing pace of urbanization has played a significant role in improving people’s access to information. These developments enable used-car owners to efficiently advertise their vehicles and share relevant information. The availability of online platforms has facilitated a broader reach, allowing more individuals to sell and purchase cars.

Drivers

Rising cost of new cars and affordability issues

The cost of new cars has increased. Additionally, the rise in prices observed in 2019, driven by mainstream passenger car segments, indicates affordability challenges in the new car market. As a result, the automotive industry has experienced a surge in future car auto sales compared to new car sales. This trend is expected to further fuel the demand for pre-owned vehicles.

Rising demand for versatile hatchback vehicles

Hatchbacks are witnessing a whopping increase in demand, owing to maneuverability in the compact spaces it offer. Market players offer hatchback cars characterized by a high roofline and compact design, further contributing to the development of the used car sales market in the region.

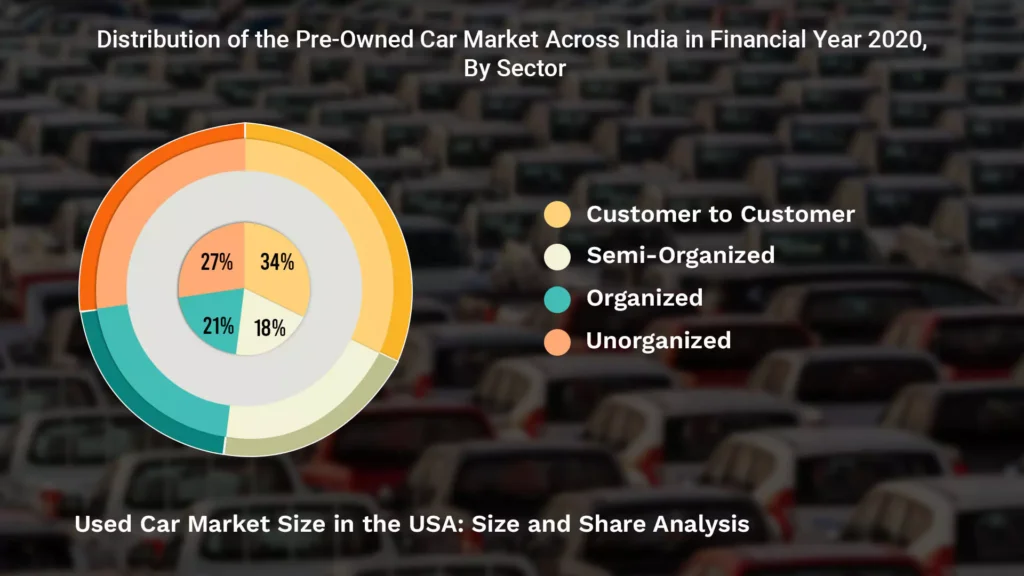

Used Car Market Size in the USA: Size and Share Analysis

The size of the used car market in USA in 2024 is estimated to be around $181.2 billion, according to IBISWorld. This represents a decline of -4.37% from 2022 but is still a significant market.

The used car market is larger than the new USA car market, with over 40 million used cars sold each year compared to around 15 million new cars. This is because used cars are generally more affordable than new cars, and they can also be more reliable, especially if they are well-maintained.

Despite the declining availability of affordable used vehicles, the secondhand US auto market still offers a significantly larger inventory compared to new vehicles available from the factory. In the first quarter of 2023, less than one% of new vehicles sold were priced below $20,000. This indicates that there are still potential savings to be found in the used vehicle market.

The latest automotive industry trends reflect that shoppers are proactively searching for the desired deal and are well-prepared regarding vehicle availability, financing options, and their own budget. With demand and prices remaining elevated, being proactive and informed before visiting the dealership is crucial in the US car market.

How are Automotive Dealers Preparing for the Future?

Supply chain issues, the growing utilization of ride-hailing services, and the economic downturn are exerting pressure on auto dealerships and reshaping their business operations and the future of used car market. If you are an automotive dealership, it’s about time you proactively consider industry-wide changes when scaling to ensure sustainable growth and meet evolving consumer demands.

Moreover, legacy vehicle dealerships are facing new competitive pressures from online dealers. Local brick-and-mortar dealerships in your vicinity are no longer the only competitors. You now also need to deal with competition from online dealers such as Carvana and Vroom. Online dealers offer the convenience of buying and home delivery. Forward-thinking auto dealers are actively preparing for future of used vehicles industry changes.

Here are a few things auto dealers are doing to prepare for the future of used car dealerships:

Homegrown Inventory

Your homegrown inventory includes vehicles that began as new sales, underwent routine service and maintenance, and were later reconditioned and sold as pre-owned vehicles.

This process is helping dealerships not only ensure a robust and high-quality pre-owned vehicle inventory but also leverage multiple used vehicle market opportunities to drive profitability throughout the vehicle’s lifecycle, beginning with the initial sale of a new vehicle.

New methods of marketing

As an increasing number of consumers opt for online vehicle purchases rather than visiting physical dealerships, it is imperative for you to explore new marketing tools to connect with potential customers in their preferred digital spaces. Establishing a strong online presence is crucial. And use predictive marketing tools to effectively engage a wide range of prospective customers.

This involves creating compelling used car websites and leveraging the power of social media marketing to effectively target potential customers with intelligent advertisements and engaging blog content. Furthermore, maintaining regular communication with customers after a purchase is essential for fostering long-term relationships and ensuring their loyalty to your dealership, encouraging repeat business and future purchases.

Future electrification

In 2024, there is a positive outlook for EV sales, representing a promising aspect within the future of used car market. Governments are implementing innovative policies aimed at encouraging EV sales while ensuring affordability and equitable access, particularly for low-income households.

Speaking of which, dealerships will play a crucial role in facilitating the mass adoption of electrification. They will help enable widespread electrification, providing a vast network of retailers and service providers with expertise in local marketing. The future of used car dealerships market is electric.

Here’s Why Future of Used Car Dealerships Could Be Disappointing

The future of used car dealerships is bleak and dealerships would need to brace themselves for tougher times, despite the growing preference for pre-owned and sustainable vehicles. Due to weaker demand and changing consumer behavior could get disappointed.

Roadblocks due to inflation rates and rising interest rates

New car prices remain close to $50,000 on average, with used cars averaging around $28,000. High annual age rates, reaching up to 11%, are causing monthly payments to rise sharply. Lee warns that further interest rate increases could lead to industry stagnation, as dealers rely on borrowed money to purchase cars, and a decline in car sales would reduce future orders. Recent improvements in inventory have prioritized higher-priced models with extensive features in new vehicle production.

The only way dealerships can maintain their consumer base is to provide incentives to shoppers struggling to find an affordable deal.

Weaker demand and changing consumer behavior

The growth of the used car dealership business is fueled by increased competition and the potential for new market entrants. Reliable services and added quality offerings have positively shaped consumers’ perceptions of the used vehicle business.

Furthermore, there is a growing demand for vehicle subscription services, which provide consumers with the opportunity to use a vehicle on a monthly basis, including maintenance, insurance, and roadside assistance. The rapid advancement of technology and frequent introduction of new vehicle models allow customers to sell or trade in their old vehicles for newer ones, offering a valuable monetary advantage. All these factors will impact the future of the used car market in the coming years.

What are the Factors that Fueled the Growth of the Used Car Industry?

The growth of the used car industry has been driven by a multitude of factors:

1) Economic Factors

Economic conditions, such as fluctuations in income and job security, have influenced consumers to opt for more affordable used vehicles over new ones.

2) Technological Advancements

Advancements in vehicle technology have extended the lifespan and reliability of used cars, making them a more attractive option for budget-conscious buyers.

3) Online Marketplaces

The rise of online car marketplaces has simplified the process of buying and selling used cars, providing consumers with a wider selection and more convenient shopping experiences.

4) Certification Programs

Certified pre-owned (CPO) programs offered by manufacturers and dealerships have instilled confidence in used car buyers by providing warranties and assurances of quality.

5) Improved Financing Options

Enhanced financing options for used cars have made them more accessible, enabling a broader range of buyers to afford these vehicles in the future of used car market.

6) Environmental Consciousness

Growing environmental awareness has led consumers to consider the sustainability of used cars as an eco-friendly choice compared to the environmental costs of manufacturing new vehicles.

7) Supply Chain Disruptions

Disruptions in the supply chain, such as the shortage of semiconductor chips, have constrained the availability of new cars, prompting consumers to turn to the used car market.

8) Changing Lifestyles

Evolving lifestyles and preferences have led to increased demand for specific types of vehicles, benefiting the second hand car market, which offers a diverse selection.

9) Longer Commutes

Lengthier commutes and urbanization have made personal transportation a necessity, driving the demand for affordable used cars.

10) Consumer Trust

Greater transparency and access to vehicle history information have fostered trust among used car buyers, reducing concerns about hidden issues.

11) Aging Vehicle Fleet

As the average age of vehicles on the road increases, more consumers are in need of replacements, bolstering the future of used car market.

12) Cultural Shifts

Changing attitudes toward car ownership and an emphasis on cost-efficiency have shifted consumer preferences towards used cars as practical and reliable transportation solutions.

Future of Used Car Sales and Aftersales: Key Takeaways

Expanding the “auto park” and using advanced pricing strategies for spare parts have partly driven market profitability growth. Additionally, the stability of the after-sales business has proven crucial for retail networks during periods of economic uncertainty.

Here’s a sneak peek into the future of used car market sales and future of used car dealerships aftersales:

- In recent years, automakers have made substantial investments in their after-sales businesses, leading to enhanced customer satisfaction and service quality. Moreover, they have expanded their offerings into new domains like tire replacement, enabling them to capture a larger portion of the after-sales market among existing customers. The advent of connectivity technology further strengthens automakers and their service networks, providing them with a competitive advantage against independent aftermarket competitors.

- Despite these advantages, the aftersales segment will see a few challenges. Vehicle quality advancements and active warranty cost management will reduce service demand per vehicle in most markets. The rise of connected vehicles will result in the loss of service and parts revenue for dealerships and automakers as remote services become more prevalent.

- Automotive customer retention rates are decreasing, particularly among owners of older cars who seek affordable service from independent providers. Independent dealerships and mobile service offerings are offering convenient, cost-effective, and digital/mobile-powered solutions to customers.

- Furthermore, the after-sales business has not effectively solidified customer loyalty, contradicting its intention to drive future car purchases. The expectation that service businesses would generate leads for new car sales has often proven unsuccessful.

How to Stand Out in and Navigate the Used Car Market?

Here is how you can stand out in the used car market:

1) Leverage online platforms and automotive digital marketingto reach a wider audience. Showcase your inventory with virtual tours and 360-degree photos for an immersive experience.

2) Provide exceptional service, personalized assistance, and transparent vehicle information. Offer value-added services like inspections and warranties to build trust.

3) Curate a diverse selection of high-quality used cars. Highlight unique features, low mileage, and certified pre-owned options to stand out from the competition.

4) Establish a strong online presence and actively manage your reputation. Encourage positive reviews and promptly address any concerns.

5) Price your vehicles competitively based on market trends. Provide attractive financing options to overcome affordability challenges and attract more buyers.

6) Use targeted campaigns on digital and traditional channels. Leverage social media, online classifieds, and partnerships with local businesses to increase visibility.

7) Offer ongoing support and value to customers. Provide maintenance packages, service discounts, and referrals to foster long-term relationships.

Want to learn more about how you can give your dealership a competitive edge? Or how Spyne.ai can help you secure the future of a used car dealership? Talk to our consultants today!

October 2024 Used Car Price Trends: A Closer Look

As we enter the final quarter of 2024, data from Black Book indicates that the used car market is showing signs of stabilization, particularly at the wholesale level. The question many are asking is: when will retail prices reflect this change for the future of used car dealerships? Before diving into that, let’s first examine the current state of wholesale prices.

1) Wholesale Truck Price Declines

October 2024 has seen a continued decline in wholesale prices for used trucks. Last week alone, trucks and SUVs saw an average price drop of 0.44%. Notably, no truck or SUV categories recorded price increases. After significant appreciation—over 60%—throughout the pandemic, particularly for full-size vans, prices have sharply declined over the last two years. However, new vehicle deals have drawn some attention away from used truck purchases, providing more balance in the market.

2) Retail Market: Used Car Inventory Growth

As illustrated by recent data, the inventory of used cars is on the rise, a shift driven by consumers capitalizing on attractive new car deals. For the first time since the pandemic, used car inventory levels are beginning to normalize, which is a significant development. This shift can be a useful tool for buyers looking to negotiate better deals in the retail market.

3) Older Used Vehicles Leading Price Growth

A unique trend has emerged: older used cars are appreciating faster than their newer counterparts. This is largely due to increased demand from buyers seeking vehicles under $20,000—a price range where newer models are often out of reach due to rising values. This has created a surge in demand for older, more affordable vehicles, reshaping the market landscape.

Price Trends for Used Cars in October 2024

In October 2024, prices for most used car segments are seeing an upward trend, with some exceptions. Pickup trucks have experienced a notable price drop, with the average price down $2,700 compared to last year and $700 since June. Luxury SUVs are also seeing a slight decline, down by $270 month-over-month. However, other categories like cars, vans, hybrids, and EVs have increased by about $300, reflecting the ongoing shortage of low-mileage used vehicles from recent model years.

Declining Used-Car Prices, Especially in the EV Market

After years of price spikes, the used car marketplace is finally stabilizing. However, high interest rates remain a challenge, with the average used car loan rate nearing 12% as of March 2024, according to Experian. This drives up the overall cost for buyers who need financing. As of August 2024, the average used car price was $25,415, according to Cox Automotive.

How Is Inflation Impacting Car Sales Trends?

Inflation is significantly impacting car sales trends in the United States, with consumers feeling the pinch of rising prices. J.P. Morgan Research anticipates that the seasonally adjusted annual rate (SAAR) of U.S. light vehicle sales will reach 14.0 to 14.5 million in 2024, a slight improvement from 13.9 million in 2022. However, this figure remains well below the pre-pandemic levels of 17.0 million vehicles sold in 2019.

The primary driver of this decline in auto sales is the record-high pricing of new vehicles, decreasing values for used vehicle trade-ins, and higher interest rates, which collectively erode affordability. This has led to what experts call “demand destruction” in the auto market.

Cox Automotive expects a further 1% decline in used car sales in 2024, due to high prices and limited inventory. A deteriorating macroeconomic outlook is further dampening consumer sentiment, discouraging potential buyers from entering the market.

The auto industry is grappling with a “lower volume, higher price” dynamic due to the lingering effects of the pandemic. While recovery may not be as rapid as initially anticipated, there is hope for an improvement in sales volume and a normalization in pricing in 2024, dependent on economic stability. (Source: J.P. Morgan Research and Cox Automotive)

Conclusion

The future of used car market is undergoing significant transformations, driven by technological advancements, shifting consumer preferences, and growing demand for electric and hybrid vehicles. Dealerships are actively adapting by offering digital-first solutions, enhancing transparency, and expanding their online presence.

However, challenges like inflation and changing consumer behavior are impacting the industry. To succeed, dealerships must leverage digital marketing, provide exceptional service, curate high-quality inventories, and offer competitive pricing and financing options.

As the global used car market evolves, adaptability and innovation are essential for dealerships aiming to thrive. Despite challenges, there are ample opportunities for those who embrace change and steer toward a successful future of used car dealerships.