Due to the pandemic, the automotive sector is undoubtedly facing one of the most challenging periods and a massive slowdown for the last couple of years. But now, the automotive industry trends show it is springing up again. Despite the looming roadblocks, the sector will witness some of the most exciting times with the increased adoption of EVs, the introduction of Internet of Things (IoT) features in automobiles, hydrogen-driven cars, and so on. This calls for a thorough analysis of recent trends in the automotive industry, So this blog brings you some of the significant car market trends in 2025 that you must know.

What are Automotive Industry Trends?

Automotive industry trends refer to changes in patterns within the automotive sector that influence vehicle design, production, marketing, and usage. Technological advancements, changes in consumer preferences, regulatory changes, and global economic conditions drive these trends. The automotive industry is highly dynamic, and trends are subject to change over time. Monitoring and understanding these trends is crucial for automakers, suppliers, and other stakeholders to stay competitive.

Some common areas of focus for automotive industry trends include electric vehicles, autonomous driving, connectivity, sustainability, mobility solutions, manufacturing advancements, and sales and distribution models. Following these trends helps greater penetration in the emerging market, like the growing adoption of electric vehicles in China and India.

Latest Automotive Industry Trends in 2025

The future trends in the automobile industry predict a roller-coaster ride for players. In 2025, the automotive industry will face global headwinds such as the energy crisis, slower global demand, and ongoing supply-chain issues. Despite these challenges, global new-vehicle sales are projected to remain flat, with new-car sales increasing. Sales of electric vehicles (EVs) are expected to grow, although governments may restructure their incentive programs.

In 2025, global car sales are expected to top 69 million. Greater market access in developing countries and emerging markets fuels it. This has led to the growing adoption of electronic vehicles in China and India.

Increased government focus on charging networks will be needed to support the expanding EV fleet. The autonomous vehicle sector will advance as UN regulators lift their speed limit. Let’s have a sneak peek at car industry trends that will shape 2025.

1. Increasing production of digital vehicles

Automakers and technology giants like Google and Tesla are incorporating more digital technology into their cars. This has created a competition to develop automotive software and digital systems to power and control innovative electric vehicles, resulting in cars produced in 2025 and beyond being full of technology to address digital touchpoints.

2. Rise in online sales

North American and European automakers offer consumers the option to buy vehicles online without visiting dealerships. With a computer or smartphone, buyers can choose desired features, secure financing, and even take virtual walk-around and test drives. In 2025, more dealerships are expected to offer online sales, vehicle inspection, and home delivery.

3. The rising preference for pre-owned/used cars

The demand is highest for vehicles under four years old, which have the latest technologies but are less expensive than new cars. This includes pre-owned electric and hybrid vehicles, and dealerships now offer certified pre-owned cars that look and function like new ones at a lower cost. Low APR financing options make pre-owned vehicles an attractive choice.

4. Rise in connected cars

Connected cars are vehicles that use wireless means to connect to the Internet of Things. They offer a safe, comfortable, and convenient multimedia experience with on-demand features that allow users to browse the web while in their vehicle. They provide various features such as remote diagnostics, vehicle health reports, 4G LTE Wi-Fi hotspots, turn-by-turn directions, and warnings of car health issues. The technology has already processed over a billion customer requests and is set to grow in 2025 with predictive intelligence and maintenance technology.

5. Rise in autonomous self-driving cars

Self-driving vehicles are becoming increasingly common and will continue to do so in 2025. Research has indicated that autonomous cars are safer, reduce downtime, expand the last-mile delivery scope, and improve fuel efficiency by 10%. Additionally, several trucking companies have tested self-driving technology, and it will soon become commonplace, with fleets of autonomous trucks sharing the road with traditional vehicles.

6. Launching of fuel cell EVs

Fuel-cell electric vehicles will emerge worldwide in 2025 due to their faster recharge, extended range, and zero emissions. Major car, truck, and SUV manufacturers are investing in fuel-cell electric vehicle development, with the support of countries like China, Germany, Japan, South Korea, and the United States. This could be the year when fuel-cell electric vehicles finally break through.

7. More automakers collaborating with tech companies

Automakers and technology companies are forming partnerships due to vehicles’ constantly evolving tech requirements. This is especially necessary for electric, connected, and autonomous vehicles, which require specialized software and advanced technology to function safely. Manufacturers are partnering with tech companies to design and produce the new operating systems necessary for the next generation of technologically advanced vehicles. More partnerships are expected in 2025.

8. Growth in the market parts of the automotive industry

As the market is growing, the demand and supply of parts increase thoroughly. The modernized vehicles available in the market have opened an opportunity for the firms that supply and also manufacture the parts. Modernized and upgraded vehicles with much more technology allow a thunder growth for the markets providing parts of the vehicles. There is a rapid growth of these markets in the long term.

9. Shortage of chips will complicate the automotive industry

The auto manufacturers who rely on the older versions of chips which are not advanced and powerful will disrupt the growth of the automotive industry. The industries have to cut back the production as it is limiting the features and technology, however, if we talk about luxury cars they have a much larger budget and complex electronic systems installed in the vehicles. Automakers need to redesign their vehicles or should look for other chip options available.

10. Consumers shifting to micro-mobility:

In this world where we are shifting to EVs, individuals usually prefer to shift to smaller vehicles which are much more affordable and environmentally friendly. They are much more convenient to use in these congested cities and parking these vehicles is much easier. Younger generations, especially Genz or millennials prefer these vehicles as they are much more attractive.

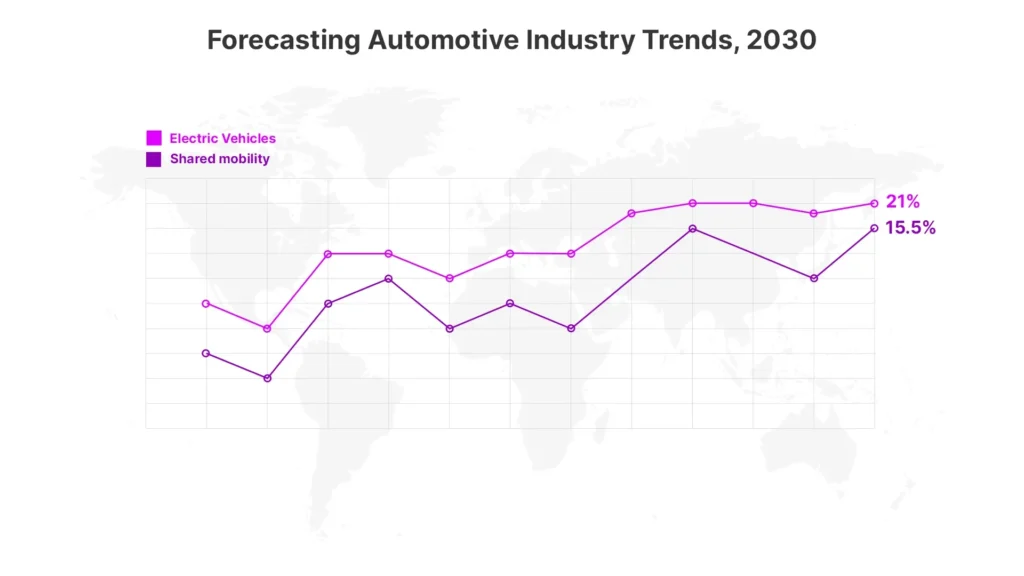

Forecasting Top 3 Automotive Industry Trends, 2030

By 2030, automotive industry trends 2030 will witness a significant shift towards electric and autonomous vehicles, driving sustainable growth in the car market. The infrastructure for EVs is expected to become more widespread and advanced, supporting the increasing number of electric vehicles on the road. Additionally, autonomous driving technology is set to dominate the industry, creating a safer and more efficient transportation system.

1. Rise of EVs

There will be a huge demand for electronic vehicles in the future as Gezs and millennials are much more attracted to the futuristic design of these vehicles also the automobile industry will be shifting their vehicle designs into EVs because of factors like government incentives, falling battery costs, and increasing consumer demand for environmentally friendly vehicles. In 2030 we will get to see most of the vehicles are EVs.

2. Shared mobility

As we can see cities are jam-packed because of traffic and the roads are congested. We might get to see people shifting to carpooling and the ownership of new vehicles would be seen less in the year 2030. Car owners would be actively using ridesharing applications often, which would be scheduled for a particular route and a particular zone.

Source: Reuters

3. Sustainable manufacturing

The automobile industry will be manufacturing vehicles from recycled materials and we will get to see the production method in 2030 would be much more clean and organized. Industries will focus on sustainable manufacturing, so there will be an availability of resources for our younger generations. Automobile manufacturers will focus on producing eco-friendly vehicles.

Source: OWS Automotive Industry – Oweis Zahran

Top Automotive Marketing Trends in 2025

Now, let’s look at the most prominent auto industry trends shaping the automotive marketing landscape:

1. Evolving video marketing & environmental sustainability

Consumer trends in the automotive industry reveal that short videos are more effective than text in converting leads into customers in the automotive industry. Dealerships can take advantage of various videos, such as how-to videos, car highlights, and customer testimonials. Automotive dealership tours are also gaining a lot of traction.

Dealers and sellers can leverage them through videos or virtual reality. More and more customers today are prioritizing environmental sustainability. Therefore, you should focus on environmentally conscious manufacturing processes and eco-friendly cars like electric vehicles.

2. Rise in VR tech adoption

The metaverse is gaining momentum as VR technology improves. Car dealerships are no exception, as recent auto trends reveal that customers prefer to experience a car or dealership before purchasing. VR allows customers to explore a car in detail without visiting a dealership. Top car brands and dealerships are embracing VR as part of their dealership photography strategies to improve the customer experience.

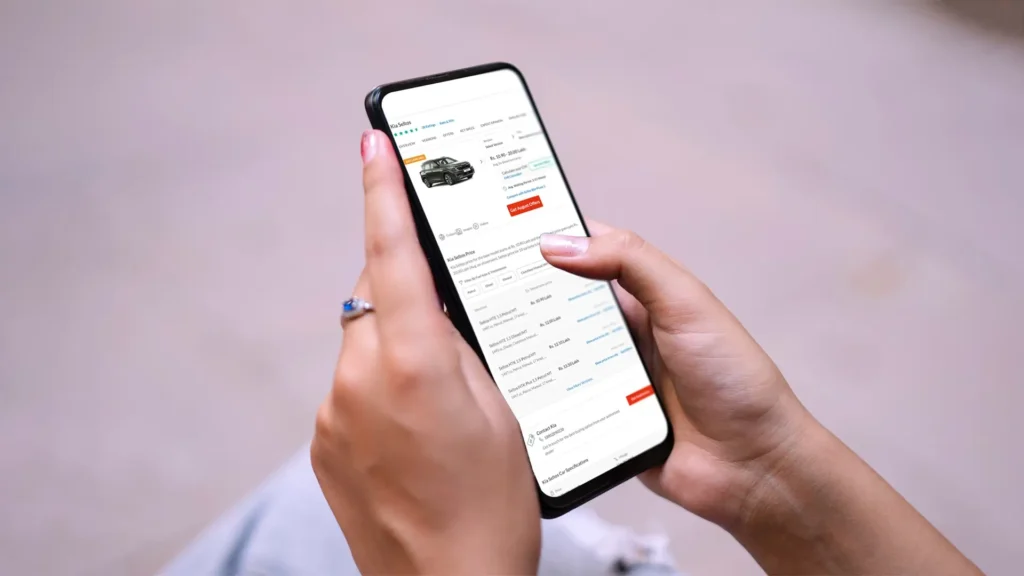

3. Optimizing mobile experiences & personalization

Smartphones are now vital in car purchases. Consumers thoroughly research their preferred car on their mobile phones, searching for the best offers and dealerships in their area. Therefore, websites must be easily readable and accessible on mobile devices, with clear calls to action. Personalization is an important part of the mobile experience. Brands provide specific offers by analyzing your needs, preferences, and behavior.

4. Upgrading built-in messaging apps & voice search

Chatbots and messaging solutions are key technology trends in the automotive industry. These tools enable dealerships to handle inquiries efficiently, freeing time for other tasks. They also facilitate the management of maintenance and repair appointments, streamlining dealership operations. Voice search assistants also optimize their interface for advertisements and voice search queries.

5. Increase in digital advertising spending

In 2022, the automotive industry’s automotive digital marketing spending increased to $17 billion and is predicted to keep growing in 2025. Experts anticipate a rise in digital advertising spending, driven by the growing mobile and social media usage rates. Dealerships need a strategic plan to capture potential buyers at different stages in the car buying process, using automotive social media marketing, click-to-call conversions, and messaging apps to attract online shoppers.

6. Automotive purchases will shift to online

After the pandemic, we developed a habit of shifting all requirements to online methods, and so do goes with the automobile industry. Our new generation which is called millennials or Genz researches everything online before the actual purchase. This year 2025, we are going to see a rapid growth of automobile sales online.

7. Aggressive growth in EVs

In the Electric Vehicle Market, 2025 Will Be the Year of More – More Models, More Incentives, More Discounting, More Advertising, and More Sales Muscle. People are shifting to EVs because of their design and their being environmentally friendly. We are going to see a massive growth of people shifting to EV vehicles. 50% of buyers are willing to opt for EVs, so businesses should surely focus on marketing electric vehicles to make their brands more broader.

8. Shift to an “Agency model”

Buyers would be shifting to a new modernized model and will directly deal with OEMs (original equipment manufacturers) and the dealer will play the role of an agent.

As per the traditional method, we used to visit the dealer and purchase vehicles from him, and the dealer used to make transactions with OEMs. However, as per the new Agency model, we will get to see that the people would directly be dealing with the OEMs and the dealer’s profit would be shared by OEMs. That will enhance in gaining the trust of society and the brand’s potential customers.

9. Conversion from Social Media

Dealership content marketing on social media platforms is getting viral on a massive scale, people are getting to know about emerging and new brands through social media, like Twitter, Instagram, and Facebook. Marketing on social media can be a great opportunity to create your brand awareness and increase sales.

Before purchasing any vehicle people check about the vehicle’s features and comparisons on social media like Youtube, also millennials and Genz’s contact brands on social media platforms rather than following the traditional trends.

10. Shift to Omni channel content strategy

These are the old and traditional methods that buyers use to contact dealers or check your products or information about the brand on search engines. Buyers check all the accessible platforms like your social media, website, videos, and more.

Providing consistent information on all the platforms helps buyers gain trust and confidence in your brand and their decision-making. You can drive strategies about asking buyers’ wants and needs rather than sending them a generic auto message.

11. Optimization in search guides

Buyers used to search for the cheap vehicles available. However, their preferences changed after some time, Buyers are willing to spend an amount, while looking for the best vehicles available in the market. Businesses would start optimizing their search guides as per the consumer’s preferences.

12. APIs conversion growth

Marketers used to rely on third-party cookies data, however, they are facing difficulty in setting up the campaigns. The conversions from API are much more feasible than data from the cookies to operate data and understand the consumer’s behavior.

What is the CASE Auto Trend?

CASE is one of the biggest automotive trends disrupting the auto industry. It stands for Connected, Autonomous, Shared, and Electrified. As per market and industry experts, these four trends represent the future of the automotive industry. It won’t take too long for the CASE to accelerate the transition of the automotive industry from the way it has been working for hundreds of years.

Here is the detailed analysis of trends-

Cars have become even more connected

The future trends in the automobile industry suggest that 2025 can be the milestone year for connected cars. The expansion will stem from the speedy spread of data that can be capitalized upon to lower expenses, streamline research and development, enhance products and services, and restrict emissions.

In addition, the IoT’s potential in the automotive industry presents a significant chance for manufacturers to revamp their marketing strategies. IoT solutions can offer numerous benefits to end-users by utilizing interconnected systems, such as better safety, driving assistance, and predictive maintenance. Collecting user data through these sensors creates ample opportunities for marketers to promote upselling.

Moreover, the growth of the automotive IoT market signals a strong trend toward connectivity. IoT creates more opportunities for manufacturers to market to consumers even after they’ve made a purchase. Consistent brand messaging across all channels, including in-car infotainment systems and websites, can help foster long-term customer relationships, promoting brand loyalty and advocacy.

Autonomous vehicles are changing the face of the auto industry

The automotive sector deals with numerous transformative factors, presenting a formidable challenge to automakers. As various technological advancements and shifts in the market landscape converge, the industry is navigating one of the most challenging periods of the past hundred years. Are automakers prepared to navigate the upcoming car industry trends, especially in the tech landscape?

A recent survey reveals automotive companies have product development and launch cycles shorter than 18 months. Many car makers, especially those bringing a fresh perspective to the automotive industry and companies proactively investing in and acquiring new technological competencies, effectively manage the ongoing changes.

However, automotive executives need help as they focus on new technology that meets consumer and regulatory demands. This has led to a shift away from traditional automotive infrastructure, which focused on powertrains, interiors, electrical systems, and safety systems. Information technology has become a crucial part of the recent trends in the automobile industry as priorities change over time.

Shared/micro-mobility presents a potential shift among consumers

Micro mobility or Mobility as a Service (MaaS) is one of the significant drivers of automotive industry trends in 2025. MaaS solutions create customized travel options by integrating various transport networks, catering to the shift from vehicle ownership to service-based transportation. Like the ‘Amazon Effect,’ this trend pressures the automotive industry to adapt. Shared mobility advocates applaud its potential to lower emissions, traffic congestion, and air pollution while offering cost savings. The EU mobility market is projected to exceed $450 billion by 2030, per Statista.

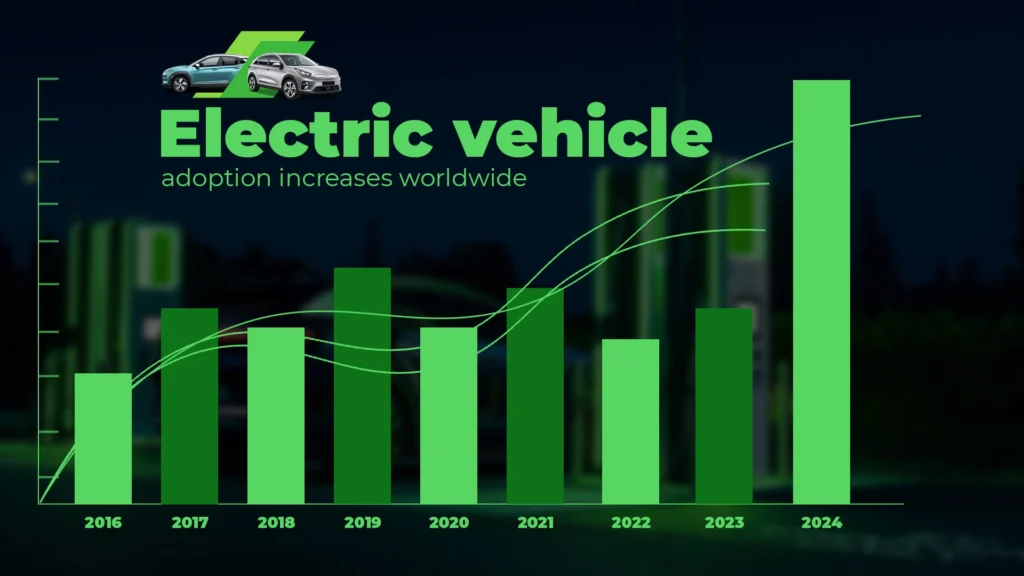

Electric vehicle adoption increases worldwide

Global passenger EV sales grew 60% from 6.5 million units in 2021 to 10.5 million in 2022. EV sales are going to increase aggressively in 2025, providing a bright spot in the automotive industry. Governments are implementing innovative policies to encourage sales without increasing costs or benefiting high-income households.

- The US will offer a $7,500 EV tax credit for eligible vehicles assembled within North America.

- France is working on a subsidized EV leasing plan for low-income households.

- However, Germany will reduce incentives for battery EVs and eliminate subsidies for plug-in hybrid EVs.

- Norway will phase out tax breaks for expensive EVs starting in January 2025.

However, EV sales in the first half of 2025 may see a slight plunge. Battery manufacturers have significantly reduced their production since early December due to the unpromising demand in the upcoming months.

However, although the Chinese EV market may take some time to adapt to the new subsidy-free scenario, the situation is optimistic. Demand may decelerate due to the end of Chinese subsidies for EVs, but it should not lead to a decrease. Apart from this, reduced access to EV charging points remains a significant challenge, according to consumer trends in the automotive industry.

Global passenger EV sales grew 60% from 6.5 million units in 2021 to 10.5 million in 2022.

Autonomous Vehicles are Changing the Face of the Auto Industry

Autonomous vehicles are one of the prime automotive industry trends of 2025. The autonomous car market in 2020 was $21 billion. The expected reach in 2026 is expected to reach nearly $62 billion at a growth of CAGR 22.75%. According to McKinsey, by 2035, autonomous driving could create $300 billion to $400 billion in revenue.

Companies like Google, Tesla, Ford, and General Motors advocate for a future without steering wheels, and Google even has its driverless car division. Self-driving cars are considered safer since they can sense their environment and operate safely within it, eliminating factors such as human error and driver fatigue. Additionally, they are more fuel-efficient.

However, there are yet to be more autonomous vehicles on the road due to the technological and safety challenges that must be overcome. Driverless cars have sometimes struggled with unexpected incidents on the road and in poor weather conditions.

Despite these challenges, there have been some success stories. Self-driving taxis are already available in parts of China and several US cities. More driverless journeys will occur as technology continues to be enhanced and refined.

Given the opportunity to significantly disrupt private transport and shape the future of the automotive industry, companies are expected to continue investing in autonomous vehicles in 2025.

Vehicle Purchases Shift Online

It all started when car buyers had no choice but to look for cars online. Virtual car shopping is the new norm and will remain a significant car industry trend for years. The booming e-commerce industry is essential to the global online car buying demand. This is further fueled by increasing awareness of convenience and supported by rising digital literacy, internet accessibility, urbanization, and disposable income levels.

Innovative car deals via social media networks also contribute to market growth. On the other hand, personal vehicles are on the rise due to improving urban road infrastructure, and the popularity of pre-owned cars among young people is also driving the market growth.

The Automotive Parts Market Continues to Grow

The future of automotive industry trends suggests that the automotive parts market will grow aggressively due to a growing demand for replacement parts and an increase in vehicle production. The segment’s sales will rise in the first six months of fiscal 2025, while the industry’s revenue will increase at the same pace to $33.8 billion. According to Globe News Wire, the entire market will grow at a CAGR of 5.5% from 2025 to 2033, logging USD 984 billion.

The specialty equipment industry recognizes the potential in off-road products and accessories, mainly for pickups and SUVs such as the Jeep Wrangler. More than half of pickup owners purchase off-road parts and engage in outdoor activities with their vehicles. Overlanding, a newer trend, combines off-roading with remote travel and camping, with products like mounted tents falling under this category.

Chip Shortages Continue to Plague Auto Manufacturers

Chip shortages have been causing myriad changes to trends that affect the automotive trends that are not all positive. Meanwhile, Carlos Tarves, CEO of automaker Stellantis, has said the chip shortages will continue to plague his industry next year. The chip lead times are still very long, especially for the car industry.

In October 2022, the delivery lead time for chips decreased by six days to 25.5 weeks, the most significant drop since 2016. Approximately 70 percent of industrial companies report faster chip supply, possibly due to weakened consumer spending and demand. These constraints are expected to persist into 2025, as semiconductor production has exceeded full production-rate utilization since 2019, with recent rates surpassing 95%.

Overall, Auto News suggests that analysts expect the chip shortage will result in a loss of 3 million in vehicle production in 2025.

Auto Sales Impacted by Low Inventory and High Prices

New vehicle inventory levels till December 2022 were 52% below December 2019 but 56% above January 2022. In late 2022, recent light-vehicle sales slowed due to high costs, increased interest rates, and limited availability, resulting in new inventory surpassing sales by a notable margin for the first time since early 2021. Additionally, production among OEMs declined due to supply chain issues.

espite growing inventory levels, new vehicle prices continue to rise, reaching a record average transaction price of $49,507 in December 2022. The best-selling vehicle in the US, the Ford F-Series pickup, has an average price of $66,451, placing it in the luxury category. Electric vehicle prices are also high, with an average of $61,448.

The high prices and increasing interest rates are causing sales to decline for dealers and automakers nationwide. Prices are expected to decrease as supply-chain issues improve, and sales continue to soften. However, interest rates may remain high as the Federal Reserve works to lower inflation.

Used car industry trends

Fewer new vehicle purchases mean consumers hold onto their vehicles longer, reducing the available used inventory and increasing prices. Additionally, interest rates for used vehicle loans are higher than those for new cars. It is anticipated that used-vehicle sales will not return to pre-pandemic levels of around 40 million units per year until 2025, similar to new-vehicle sales.

However, as per used car industry trends, prices for used vehicles have dropped overall due to lower sales, but specific segments like pickups and vans have held their value better than others like SUVs and CUVs, which have seen the most significant price drops despite their popularity among new car buyers. The demand for work vehicles has helped pickups and vans hold their value.

Hydrogen May Fuel the Future of the Automotive Industry

To address concerns over EV battery availability and longevity, Toyota and other automakers are exploring the potential of hydrogen fuel cell vehicles, which emit only water and offer a more widely available alternative to batteries.

With consumers increasingly prioritizing environmental performance when purchasing vehicles, automakers must focus on reducing emissions and developing more sustainable transportation options. Most car buyers now consider a vehicle’s environmental impact before purchasing, with many willing to pay a premium of over £2,000 for greener emissions.

Luxury Car Brands See Growth in 2025

According to Market Watch, the Luxury Cars market had a value of USD 409,263.47 million in 2022. The luxury car market size has grown strongly in recent years. It will grow from USD 582.19 billion in 2023 to USD 632.68 billion in 2025 at a compounded annual growth rate (CAGR)of 8.7%.

Luxury car brands are experiencing growth due to increased tangible luxury offerings and rising disposable incomes. The demand for sustainable and eco-friendly transportation, like electric luxury vehicles, also drives market growth. The adoption of pre-owned luxury cars is increasing due to easy access to financing and lower entry prices. Manufacturers are investing in innovative mobility technologies, such as personal voice assistance, autonomous driving, and AI and ML, creating a positive market outlook.

Automotive Sourcing Models are Changing

The car market trends are shifting towards regional suppliers to diversify their supply chains and mitigate risks. This trend is driven by increasing demand and supply chain disruptions. OEMs seek alternative sources to improve sourcing flexibility and bring products to market faster. The U.S. and China trade war has also influenced the search for alternative sourcing options. Labor costs are another factor in the rise of local sourcing, with countries such as Taiwan, Cambodia, and Laos providing a lower-cost labor alternative to China.

In addition, assembling a car involves a massive number of parts (30,000 on average), with materials accounting for a significant portion (40-50 percent) of the manufacturing cost. To maintain cost competitiveness, automotive procurement teams must be critical in managing supplier networks and supply chains for existing and upcoming vehicle models. This includes aligning new technologies and business models with the company’s vision.

Technology Challenges Yield Growth Opportunities

The emergence of CASE (Connected, Autonomous, Shared, and Electrified) technologies is changing the industry like never before. This will drive growth opportunities for automakers in the years to come and shape the automotive industry outlook in the future.

By 2035, approximately 16% of all new LV (light vehicle) sales in the US are predicted to consist of advanced automated vehicles (L3, L4, and L5). These estimates are considered conservative in light of the assumption that EVs will attain total cost-of-ownership equivalence with ICE vehicles by 2025 and depend on forecasts regarding the development of EV-charging infrastructure.

In addition, OEMs will build new operating models to support new businesses. Auto OEMs and many Tier 1 and even Tier 2 suppliers will likely need to reorganize and widen their old operating model to accommodate new business-generating products and services and draw in the latest workforce skills. Undoubtedly, auto OEMs will keep concentrating on their core business, which is generally based on development and industrial platforms and consists of automobiles, aftermarket repairs and maintenance, and financial services related to those vehicles.

Conclusion

We hope this blog helps you understand the upcoming automotive industry trends in 2025. The industry trends show a positive perspective for the times to come despite the expected global slowdown and supply chain disruptions. As a car seller, dealer, or manufacturer, you must only build flexible yet solid automotive marketing strategies and create a strong sense of customer trust and loyalty. Make sure you stand out from your peers by focusing on every intricate detail through marketing and staying at the top of buyers’ minds.