You’ve spotted the perfect car, a sturdy sedan that’s just right for your daily commute. You’re ready to sign the papers, but when you apply for a loan at a traditional dealership, your credit score throws a wrench in the plan. Banks say no, and that dream car starts to slip away.

Buy here pay here (BHPH) dealership is a solution meant for buyers who struggle with traditional financing. These buy here pay here car lots not only sell buy here pay here cars, but they finance them too, acting as both the seller and the lender.

But is this approach all it’s cracked up to be? While pay here buy here can be great for some, it comes with its own risks. Let’s explore what is a buy here pay here dealership, how it works, and whether it’s the right choice for you.

Buy Here, Pay Here Car Dealership: Meaning, How It Works

A buy here pay here dealership is a unique type of car lot that combines selling vehicles with in-house financing. The buy here pay here meaning is simple: you purchase the car from the dealership (“buy here”) and make your loan payments directly to them (“pay here”).

Unlike traditional dealerships that rely on banks or credit unions for loans, buy here pay lots to handle everything themselves. This setup is a lifeline for buyers who might not qualify for standard auto loans due to poor credit, no credit, or financial setbacks like bankruptcy.

Buy here pay here car lots are especially popular in communities where access to traditional financing is limited. They cater to a wide range of buyers, with no credit history to those rebuilding their finances after tough times. For businesses, these lots also offer opportunities for car merchandising, allowing dealers to showcase vehicles through professional displays or online platforms. But while the process is straightforward, it’s not fit for everyone. Understanding how does buy here pay here work and evaluating its benefits and drawbacks is important to make an informed decision.

What Is Buy Here, Pay Here (BHPH)?

Buy here pay here dealership is a dealership that offers in-house financing for the vehicles they sell. The term buy here pay here reflects the process: you select a car from their lot and pay the dealership directly for it over time. These lots specialize in used cars and they’re designed to help buyers who might be turned away by banks or credit unions.

A key feature of buy here pay here no credit check dealerships is their leniency with credit requirements. Unlike traditional lenders, they focus on your ability to make payments, looking at factors like your income, employment stability, and down payment.

This makes buy here pay here cars accessible to those with low credit scores, past bankruptcies, or no credit history at all.

How Buy Here, Pay Here Works

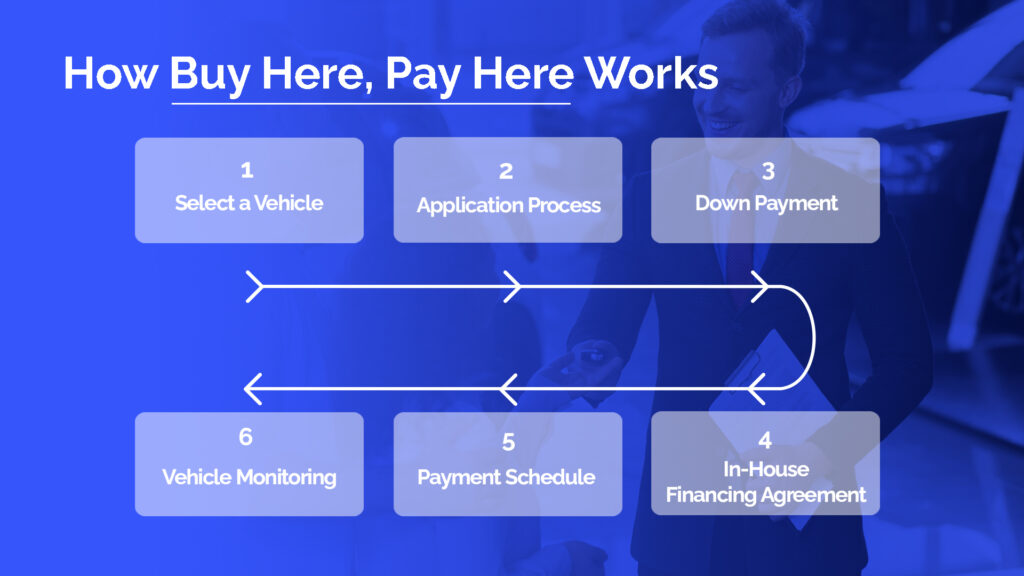

Curious about how does buy here pay here work? The process is designed to be simple, but it has elements that set it apart from traditional car buying. Here’s a step-by-step look at how you can drive off in a buy here pay here car:

Select a Vehicle

Buy here pay here car dealership typically offer used cars, mostly at budget-friendly prices. The inventory might include older models or vehicles with higher mileage, though some lots carry newer, well-maintained options. Many dealerships enhance their appeal with a professional car photoshoot to show their inventory online or in marketing materials.

Application Process

Instead of applying for a bank loan, you provide financial information directly to the dealership. This might include pay stubs, proof of residence, and personal references.

Down Payment

Most buy here pay here dealership require a down payment, which can range from a few hundred to a few thousand dollars, depending on the car’s price and your finances. A larger down payment can lower your monthly payments or interest rate.

In-House Financing Agreement

The dealership creates a payment plan, often with weekly, biweekly, or monthly payments. Interest rates are higher than traditional loans since the dealership assumes the risk of lending to buyers with poor credit.

Payment Schedule

You make payments directly to the dealership, either in person or online. Some pay here buy here lots require in-person payments, which is where the “pay here” part comes in. Missing payments can lead to swift repossession due to strict policies.

Vehicle Monitoring

Many buy here pay here dealership install GPS trackers or ignition kill switches on their vehicles. These devices allow the dealership to locate the car or disable it if payments are missed. Before finalizing the purchase, a thorough vehicle inspection by a trusted mechanic is crucial to ensure the vehicle is in good condition.

What Are Alternatives to Buy Here, Pay Here Financing?

While buy here pay here can be a quick solution for getting a car, it’s not the only option for buyers with less-than-perfect credit. Exploring alternatives can help you find a better deal or avoid the high costs of buy here pay here financing. Here are some options to consider:

Subprime Auto Loans

Some banks and credit unions offer loans for buyers with poor credit, known as subprime loans. These often have lower interest rates than buy here pay here financing, though still higher than standard loans. Working with a subprime lender can save you money in the long run.

Co-Signer Loans

If you have a trusted friend or family member with good credit, they can co-sign a traditional auto loan. This increases your chances of approval and may secure a lower interest rate. Keep in mind that the co-signer is responsible if you miss payments, so this option requires clear communication.

Credit Union Financing

Credit unions often have more flexible lending criteria than banks and may offer better terms for buyers with lower credit scores. Joining a credit union (if eligible) can open up affordable financing for car buy here pay here alternatives.

Personal Loans

Some buyers use personal loans from banks, online lenders, or peer-to-peer platforms to purchase a car outright. This gives you more freedom to shop at any dealership, but interest rates and approval depend on your credit.

Saving for a Cash Purchase

If your budget allows, saving up to buy a used car outright eliminates the need for financing. This approach avoids interest payments and gives you more negotiating power at private sales or smaller lots. A 360 car virtual tour of the car online can help you evaluate vehicles remotely before committing.

Leasing with Poor Credit

While less common, some leasing companies offer programs for buyers with lower credit scores. Leasing typically involves lower upfront costs but may not suit those seeking long-term ownership.

Pros and Cons of Buy Here, Pay Here Car Lots

To help you decide if buy here pay here car lots are right for you, let’s weigh the advantages and disadvantages of choosing a buy here pay here car.

Pros of Buy Here, Pay Here

- Accessible for All Credit Types: The buy here pay here no credit check model makes these dealerships ideal for buyers with poor or no credit history, including those with bankruptcies or repossessions.

- Fast Approval: Unlike traditional loans with lengthy applications, BHPH approvals are quick.

- Flexible Payment Schedules: Weekly or biweekly payments can be easier to manage for those with irregular income, unlike monthly payments required by banks.

- Credit Rebuilding Opportunity: Some buy here pay here dealership report payments to credit bureaus, helping you improve your credit score with consistent payments.

- One-Stop Shop: Since the dealership handles both the sale and financing, the process is streamlined, eliminating the need for third-party lenders.

Cons of Buy Here, Pay Here

- High Interest Rates: Buy here pay here loans often carry interest rates of 15-20% or higher, making the total cost of buy here pay here cars much higher than traditional loans.

- Limited Vehicle Selection: BHPH lots typically offer used cars, which may have higher mileage or fewer features compared to traditional dealerships.

- Risk of Repossession: Missing even one payment can lead to quick repossession, especially with GPS trackers or kill switches in place.

- Higher Total Costs: High interest rates and shorter loan terms increase the overall cost of a buy here pay here car compared to other financing options.

- Potential for Lower-Quality Vehicles: Some BHPH lots may sell cars with hidden issues, so it’s critical to have the vehicle inspected by a mechanic before buying.

Is Buy-Here, Pay-Here Financing a Good Idea?

The answer depends on your unique situation, financial goals, and ability to manage payments. Here are some scenarios to help you decide:

-

Choose Buy Here, Pay Here If:

-

-

- You have poor or no credit and can’t qualify for traditional loans.

- You need a car quickly and can’t wait for a lengthy loan approval process.

- You’re confident in your ability to make regular payments, even with higher interest rates.

- You’re looking for a short-term vehicle solution and don’t mind a limited selection of buy here pay here cars.

- You want to rebuild your credit and the dealership reports payments to credit bureaus, with some even show their vehicles through a car 360 spin for better buyer confidence.

-

-

Avoid Buy Here, Pay Here If:

-

- You can qualify for a subprime loan or other financing with lower interest rates.

- You’re not comfortable with the risk of repossession due to strict payment terms.

- You have the time and resources to save for a cash purchase or explore other financing options.

- You’re concerned about the higher buy here pay here costs or the quality of the vehicles offered.

To make the most of buy here pay here financing, take these steps:

- Research the Dealership: Look for reputable buy here pay here car dealership with positive reviews and transparent terms.

- Inspect the Vehicle: Have a trusted mechanic check the car for issues before signing the contract.

- Understand the Terms: Read the fine print, especially regarding interest rates, payment schedules, and repossession policies.

- Budget Wisely: Ensure you can afford the payments, including the high interest rates, without straining your finances.

Conclusion

The buy here pay here dealership model offers a great solution for those who need a car but face barriers with traditional financing. The buy here pay here no credit check model makes car ownership accessible to almost anyone, but it comes with higher costs, stricter terms, and potential risks.

For some, buy here pay here cars provide a quick path to the driver’s seat and a chance to rebuild credit. For others, alternatives like subprime loans or saving for a cash purchase might be a better fit. Before committing to a buy here pay here car, weigh the pros and cons, research your options, and ensure the dealership is trustworthy.