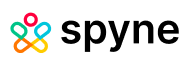

Senate Republicans introduced a new tax and budget proposal that could reshape the U.S. electric vehicle (EV) market. The bill aims to eliminate the $7,500 federal Electric Vehicle Tax Credit for new EVs and restrict other incentives that have helped many Americans afford cleaner transportation. This move signals a clear shift away from the pro-EV policies championed by the Biden administration.

A Shift Away from EV Incentives

Electric vehicle incentives have been a key part of the federal government’s clean energy strategy. These tax credits lower the cost of EV ownership and encourage consumers to switch from gasoline-powered cars. By ending or reducing these benefits, the proposal could slow EV adoption and alter market dynamics, particularly for lower- and middle-income buyers who rely on financial support to go electric.

New Electric Vehicle Tax Credit Could End Within Six Months

Under the Republican proposal, the $7,500 Electric Vehicle Tax Credit for new EV purchases would expire just 180 days after the bill becomes law. For many consumers planning to buy an EV, this would shrink the window to claim the credit. Without this support, EVs could become financially out of reach for a large number of potential buyers, particularly as inflation and financing costs remain high.

Immediate Changes for Leased EVs

The bill also targets leased electric vehicles, especially those manufactured outside North America. Currently, all leased EVs qualify for the credit, regardless of where they’re built or where components are sourced. That would change immediately under the new plan. Starting June 16, leased EVs assembled outside North America would no longer be eligible for the tax credit.

For a limited time (180 days after the bill’s passage) leased EVs could still qualify, but only if they meet strict conditions. These include North American assembly and compliance with sourcing rules for batteries and critical minerals. Automakers would need to adjust their supply chains quickly to keep lease incentives in place.

Used Electric Vehicle Tax Credit Also at Risk

The proposal also seeks to eliminate the $4,000 Electric Vehicle Tax Credit for used EVs. This credit would end 90 days after the bill becomes law. Designed to make EVs more accessible for budget-conscious buyers, the used EV credit has supported growth in the secondhand electric vehicle market. Without it, many first-time or lower-income EV buyers may lose a key opportunity to enter the market affordably.

Political Divides on the Road to EV Adoption

This bill marks a clear political divide in energy policy. The Biden administration has emphasized EV adoption as central to its climate goals. It has backed federal investments in EV manufacturing, infrastructure, and consumer incentives. Republican lawmakers, however, view current tax credits as expensive, inefficient, and unfair. They argue that such programs distort market competition and burden taxpayers. The proposed cuts reflect a broader GOP strategy to reduce federal spending on clean energy.

House Takes a Different Route

The Senate’s proposal contrasts with a version from the House of Representatives, which takes a more moderate approach. The House bill would allow the $7,500 EV credit to remain in place through the end of 2025, and even 2026 for automakers that haven’t yet sold 200,000 EVs. These differing timelines set the stage for a legislative debate. Whether Congress will reach a compromise remains uncertain.

What This Means for Drivers and Automakers?

If the Senate plan passes, it could have serious effects on both consumers and automakers. Buyers may face higher out-of-pocket costs for EVs, making them less attractive during a time of economic uncertainty. Automakers, especially those relying on international factories and global supply chains, may need to restructure production to meet eligibility requirements.

For drivers considering an EV, the landscape could shift quickly. A shorter window to claim credits, along with stricter rules for eligibility, may discourage adoption. Unless lawmakers find common ground, consumers could lose a key financial incentive to move toward electric vehicles.