Explore our bank car auction 2024 guide, your key to understanding this distinctive marketplace and unlocking the potential for incredible vehicle deals. Here, you’ll gain valuable insights into the intricacies of car auctions by bank, including what they are, how they work, and the steps you need to follow to purchase a vehicle successfully. Whether you’re a seasoned auction-goer or a first-time bidder, this blog is your roadmap to securing a quality car at a price that fits your budget. Dive in and discover how to navigate the world of bank owned car auctions with confidence and precision.

What is a Bank Car Auction?

Bank car auction also known as repo auction, refers to repossess auctions that sell cars that have been repossessed. Cars at auction are repossessed as of missed payments. It is sold in “as-is” condition. It is a public event where financial institutions like banks and finance unions sell vehicles repossessed from borrowers who defaulted on their loans. These repossessed cars typically go for lower prices than you’d find at a dealership because the bank wants to recoup its losses quickly. Bank auto auctions can be a great way to find a good deal on a used car. However, before you bid on a vehicle, it’s crucial to comprehend how these auctions operate.

Why You Should Buy Cars from Bank Car Auction?

The lure of potentially scooping up a great car at a low price makes bank car auctions a great option for many buyers. Banks are typically eager to sell repossessed vehicles quickly to recoup their losses, so bank-repossessed cars with prices often set prices lower than what you would find at a traditional dealership. Additionally, the bank-seized car auctions offer a wide variety of cars to choose from, including different makes, models, years, and conditions. This means that you have a good chance of finding a car that meets your needs and budget.

However, it is important to note that buying a car from a bank e auction cars also comes with some risks. For example, you may not be able to test drive the car before you buy it, and you may have to purchase the car as-is, meaning that you are responsible for any repairs that are needed. Additionally, there is always the possibility that the car has been damaged or has hidden problems.

To minimize the risks involved in buying a car from a bank vehicle auction, it is important to do your research and inspect the car carefully before you place a bid. You should also have a mechanic inspect the car before you purchase it. If you are willing to take on the risks involved, buying a car from a bank repo car auctions can be a great way to get a good deal on a quality car.

What are The Different Types of Bank Car Auctions?

We surely have seen car bank auctions on the internet or TV shows and have fantasized about being a part of it. Precisely cars are something that depicts an individual, some of us still believe that bank car auctions from bank are very rare and expensive, however, here comes the main twist. Bank repo auctions allow car enthusiasts to be a part of it and you can surely get a great deal on the wheel.

In this huge world where we have a variety of cars available simultaneously, there are capitec repossessed cars as well they have been categorized below:

1) Off-lease vehicles

These vehicles are pre-owned certified vehicles. The off-lease vehicles available for bank car auction by bank might have an accidental history and cars have a high chance of having low mileage however, if you look at the brighter side it can surely be a value for the deal as it might be used gently before, which requires a thorough inspection.

2) Repossessed vehicle auctions

Vehicles enlisted in these auctions are in high demand because the vehicles available here are below market price. Repossessed vehicle auctions are a way for the banks to sell the vehicles of the defaulters who were not able to pay their loans.

3) Bank-seized vehicle auctions/impound auctions

In these auctions, everyone can participate other than the original owner of the vehicle. These vehicles are impounded or seized could be due to traffic violations, and could be involved in any crime. One can get the cars at affordable prices as the motive is to retrieve the recoup the cost.

4) Bankruptcy lease auctions

These auctions are held to claim the bank’s money back. These vehicles are seized by the bank because the original owners got bank corrupted. Banks sell the defaulter’s assets to claim their money back, you can surely find a great deal on these auctions as these vehicles are mostly well maintained.

5) Fleet vehicle auctions

These vehicles are owned by companies or organizations, the owners of the vehicles are not a family or any individual. These vehicles are sold because the organizations want to get rid of them and are looking for an upgrade.

What are The Benefits of Bank Car Auctions

Bank repossessed car auctions are a feasible way to acquire your desired automobile, bank repo auctions offer you an unbeatable deal on wheels. There are some fortunes for your benefits from the public bank car auction list which are stated below:

1) Lower Prices

This is the biggest perk. Banks are looking to offload repossessed vehicles quickly, which means you can potentially find fantastic vehicles at lower prices than traditional dealerships.

2) Variety of Cars

Bank auctions feature a wide range of vehicles from various manufacturers, models, and years. You might find anything from a budget-friendly sedan to a luxury SUV.

3) Online Inventory

This allows you to browse their inventory online before the auction. This lets you shortlist vehicles that interest you and avoid wasting time.

4) Vehicles under warranty

You can get a deal on your desired cars that are under warranty because bank auto auctions take place consequently to recover their losses expeditiously, which surely gives a chance they will sell a car that is still under warranty.

How Does the Bank Car Auction Process Work?

The bank auto auction process can vary slightly from bank to bank, but here is a general overview:

1) Find a car auction bank near you. You can find information about upcoming bank e auctions car or in local newspapers. You can also contact banks in your area to ask if they have any auctions scheduled.

2) Attend the preview. Before the auction, there will be a preview period where you can inspect the vehicles that will be up for auction. This is your chance to check the condition of the vehicles and determine which ones you are interested in.

3) Sign up to bid in the auction. Registration and obtaining a bidder number are prerequisites for bidding in the auction. Usually, a deposit and some personal details are required for this.

4) Place a bid on the cars. You will place a bid on the vehicles you are interested in during the auction. Make sure you set and stick to a maximum bid for each vehicle. It’s simple to overspend during the auction because of the excitement.

5) Pay for the vehicle. If you are the winning bidder, you must pay for the vehicle immediately. Most auctions require immediate payment.

6) Take possession of the vehicle. Once you have paid for it, you can take possession of it.

The excitement and competitiveness of auctions can lead to impulsive decisions and overspending, so it’s critical to maintain a clear budget and stick to it throughout the bidding process. Additionally, as mentioned earlier, bank auto auctions often sell a car “as-is,” which means you are responsible for any necessary repairs and maintenance. To minimize risks and ensure a successful purchase, inspect vehicles carefully before bidding, and consider having a trusted mechanic assess their condition.

Top 10 Pro Tips To Prepare For a Bank Car Auction

To win at a bank car auction online and get the best deal you must know the best tips & tricks that can help you for a successful car-buying experience at auction and help you land the best deals. Here we have mentioned the best 10 tips to prepare for a bank car auction:

1) Know your wants: Ensure what you are looking for and stick to it, don’t get anything irrelevant to your needs.

2) Set a Budget: Decide a budget and stick to it don’t get carried away in the bidding process.

3) Take a Friend: Take your friend along with you so that you can get an extra opinion that will help.

4) Separate facts from fiction: Don’t believe everything the seller tells you. Inspect the car yourself and rely on mechanic’s reports.

5) Check the VIN: A vehicle history report will reveal accidents, flood damage, or other issues.

6) Know the car’s value: Research similar cars to get a good idea of a fair price.

7) Watch others: Observe how bidding works and how other participants behave.

8) Don’t get carried away: Stick to your budget and don’t get caught up in the heat of the moment.

9) Have a mechanic on speed dial: A trusted mechanic can assess a car quickly and help you avoid expensive surprises.

10) Bring cash or a certified cashier’s check: Be prepared to pay immediately if you win your bid. Bank auctions typically won’t accept other forms of payment.

Pros and Cons of Buying a Car at Auction

In the world of car buying, auctions offer a unique avenue with both advantages and disadvantages to consider. Understanding these intricacies is crucial before diving headfirst into the fast-paced world of bidding wars.

| Pros | Description | Cons | Description |

| Great Deals | You might find rare cars or vehicles below market value due to competitive bidding. | Risk of Buying a Lemon | There’s no guarantee of the car’s condition. You could end up with a vehicle needing major repairs. |

| Fast and Efficient | The auction process is typically quicker than negotiating at a dealership. | No Warranty or Returns | Cars are sold “as-is” with no warranties or return options. You’re responsible for any repairs. |

| Wide Variety | Auctions often have a large selection of vehicles, from everyday cars to unique finds. | Limited Inspection Time | You might not have enough time to thoroughly inspect the car’s condition before bidding. |

| Transparent Pricing | The bidding process is open and public, so you know exactly what the car is going for. | Pressure to Bid | The competitive atmosphere can lead to impulsive decisions and overpaying. |

| Uncertain History | Information about previous owners and maintenance might be limited. | Salvage Titles | Salvage car auction sells cars with salvage titles, which can be difficult to insure and register. |

How to Buy a Car from Bank Auction?

Buying a car at a bank auction can be a great way to find a good deal on a used vehicle. Here are the steps you can follow, including the required statement:

1) Research the Auction

Start by identifying the banks or financial institutions that are hosting car auctions. You can typically find information about upcoming auctions on their websites or by contacting them directly.

2) Attend Pre-Auction Inspection

Many bank auctions offer pre-auction inspection days where you can physically examine the vehicles that will be on the block. This is a crucial step to assess the condition of the cars and determine which ones you’re interested in.

3) Register for the Auction

To participate in the auction, you’ll likely need to register in advance. This registration process may involve providing your personal information, including identification, and agreeing to the auction’s terms and conditions.

4) Get Your Finances in Order

Ensure that you have your finances in order before attending the auction. Know your budget and be prepared to pay a deposit if you win a bid. The accepted payment methods may vary, so check with the auction organizers.

5) Attend the Auction

On the day of the auction, arrive early, and bring your identification and any necessary registration paperwork. It’s also a good idea to bring a mechanic or someone knowledgeable about cars to help you assess the vehicles.

6) Bid Responsibly

When the auction starts, listen to the auctioneer and raise your hand or signal your bid when the vehicle you’re interested in comes up for auction. Be sure to set a maximum bid amount and stick to it to avoid overbidding.

7) Winning the Auction

If you have the winning bid, you’ll need to complete the paperwork, pay the required deposit, and arrange for payment of the remaining balance, usually within a specified time frame. Make sure you understand the terms and conditions for payment and vehicle pickup.

8) Vehicle Transfer and Paperwork

Once you’ve paid for the vehicle, you’ll need to complete the necessary paperwork to transfer ownership. This often includes a bill of sale, title transfer, and any applicable taxes or fees.

9) Vehicle Pickup

Coordinate with the auction organizers to pick up your newly purchased vehicle. Be prepared to provide identification and any required documentation to take possession of the car.

10) Finalize Ownership Transfer

After taking possession of the vehicle, it’s essential to ensure that the ownership transfer is properly processed. Buying a car at a bank auction can be a rewarding way to find a good deal on a vehicle.

Tips for Buying a Car from a Bank Car Auction

Buying a car from a bank car auction in 2023 can be a rewarding experience if done with careful planning and consideration. Here are key tips to guide you through the process with success:

1) Research Cars in Advance

Before the auction starts, study the car you’re interested in. This includes checking their market value, history reports, and estimated repair costs if needed. Have a list of potential cars you’d like to bid on.

2) Be Flexible

While it’s good to have specific cars in mind, be open to different options. You might discover great deals on vehicles you hadn’t considered.

3) Know the Rules

Familiarize yourself with the auction’s rules and procedures. This includes understanding how the car bidding process works, payment methods, and any additional fees or taxes that may apply.

4) Arrive at the Auction Early

Arriving early allows you to inspect the vehicles and register if you haven’t already. It also provides time to get comfortable with the auction environment.

5) Bring Someone with You

Having a companion with you, such as a friend or family member, can provide assistance. They can provide a second opinion, assist with paperwork, and help you stay focused during the bidding process.

6) Stick to Your Budget

Finalize your budget in advance and stick to it. It’s easy to get caught up in the excitement of the auction, so having a clear spending limit is crucial to avoid overbidding.

7) The Car Is Sold “As Is”

Keep in mind that cars at bank e auctions car are typically sold “as is,” which means there are no warranties. Be prepared for potential repair or maintenance costs after purchase.

8) You May Need Cash to Buy the Car

While some auctions accept credit cards or checks, many prefer or even require cash or cashier’s checks for payment. Check the accepted payment methods ahead of time to ensure you have the necessary funds available.

9) Inspect the Vehicles

Take the time to thoroughly inspect the vehicles you’re interested in. Look for signs of damage, wear and tear, or any other issues. If you’re not knowledgeable about cars, consider bringing a mechanic to help with the inspection.

10) Set a Maximum Bid

Decide on a maximum bid for each car you’re interested in, factoring in your budget and any potential repair costs. Stick to this limit during the bidding process.

11) Pay Attention to Auctioneer Calls

Listen carefully to the auctioneer’s descriptions and calls. They may provide important information about the vehicle’s condition, history, or any disclosures.

12) Be Patient

The right car may not come up right away, be patient. Wait for the vehicles that match your criteria and budget.

13) Check the Title and Ownership Documents

Before bidding, make sure the title and ownership documents are in order. Any discrepancies or issues with the paperwork can complicate the buying process.

Remember that bank repo auctions can be competitive, so it’s important to stay composed and focused throughout the process. By following these tips, you can increase your chances of getting a good deal on a vehicle that meets your needs.

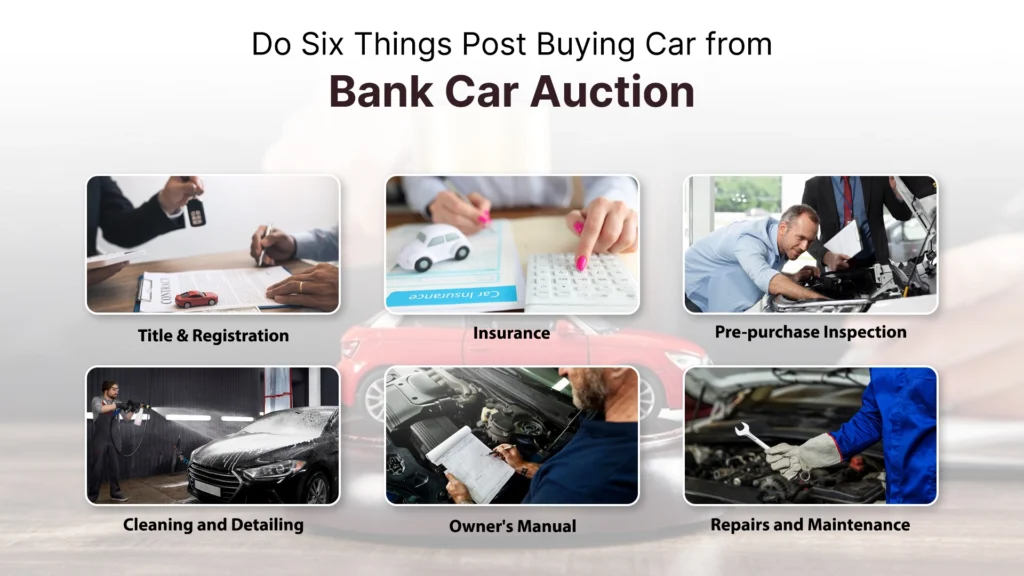

Do These Six Things Post Buying Car from Bank Car Auction

Yay! Now that you have won the car you must ensure a few checks that you need to do post purchasing the car from an auction. Here is a detailed checklist to ensure a smooth transition and get your new car on the road safely and legally:

Title & Registration

1) Once you have purchased your vehicle ensure to check the vehicle identification number & check the bill of sale & title accuracy.

2) Check the process for transferring titles as each state has a different process so be sure to research yours for any specific instructions & fees.

3) Once you own the vehicle title ensure to register the vehicle under your department motor vehicle.

Insurance

1) Explore different insurance companies to find the best coverage at the most competitive rate.

2) Check your state’s minimum insurance requirements and consider if you need additional coverage, such as collision or comprehensive.

Pre-purchase Inspection (if not done before)

1) As you know the condition of the car is typically sold in “as-is” condition so get a mechanic to inspect the car as it will help identify any fault or damage and the repair estimation.

2) Provide the mechanic with the car’s history (if available) and any concerns you have. Discuss the inspection findings thoroughly and get a written report.

Cleaning and Detailing

1) Maintain your car thoroughly by cleaning its interior and exterior.

2) Consider a professional cleaning expert for deep cleaning and restoring the car’s shine.

Repairs and Maintenance

1) Based on the mechanic’s inspection, prioritize and address any crucial repairs that would affect safety or drivability.

2) Investing in preventative upkeep can save money in the long run by stopping principal repairs down the street.

Owner’s Manual

1) Familiarize yourself with the proprietor’s guide. It consists of precious records approximately your vehicle’s features, operation, upkeep schedules, and troubleshooting suggestions.

2) Store the owner’s guide in a safe and effortlessly handy region within the automobile, like the glove compartment.

Why You Should Avoid Buying Cars From a Bank-Owned Car Auction?

Bank-repossessed cars appear as an affordable option to purchase your new wheels however, unfortunately, there are a few drawbacks that underlie the risks of your purchase which can turn out to be unsafe. If you buy a car from bank auctions it can lead to some hidden risks which can be problematic and could lead to a pitiful decision. It is necessary to be assured of the knowledge before you make any decision.

1) Lack of Warranty or Guarantees

As you are not making any purchase from any dealer or any individual, there is a risk that it might turn out to be out of warranty or warranty. You have to assume your purchase and if there is any absence the responsibility of it fully goes to the buyer.

2) Possibility that you are buying a stolen vehicle:

Bank car auctions have a variety of vehicles however, there is no such certification that the car being sold in the auction is legally precise and not a stolen vehicle. There is a chance that the vehicle you purchase is a stolen vehicle and if you make a purchase you might have to face the consequences. Also, legal entanglements and there is a chance that you might get confiscated.

3) Unknown vehicle history

There is no track or any certified information that the auctioned vehicle history is clear and it might be an unsafe purchase because there might be hidden damages, it might be severely damaged or you also might require costly repairs, which can lead to an inferior purchase

Final Words

Bank car auctions present an exciting option for those in search of quality vehicles at budget-friendly prices. With careful research and adherence to essential tips, you can confidently participate in these auctions and drive fantastic deals. Just remember, the journey doesn’t end at the auctioneer’s hammer, it continues with paperwork, transportation, and legal compliance. When approached methodically, bank auto auctions can offer an exceptional way to acquire your next car.