Life happens, whether you like it or not. Maybe you’ve lost your job, dealt with a medical emergency, or your financial situation just took a nosedive. When you can no longer afford your car payments, it’s easy to feel like you’re out of options. One solution people often consider is voluntary repossession which basically means surrendering a car back to the lender.

On the surface, it might seem like a clean break. But before you drive your car to the dealership and hand over the keys, it’s crucial to understand what you’re really signing up for. Voluntary repossession isn’t just about saying goodbye to your car but about how that decision could impact your credit, finances, and even your emotional well-being. If you’re thinking about voluntary surrender of vehicle ownership, take a few minutes to read this. It could save you a ton of stress, surprise fees, and long-term regret.

Let’s break it all down, plain and simple.

What Is Voluntary Repossession?

Voluntary repossession (also called voluntary surrender of vehicle or voluntary car repossession) means you return your car to the lender because you can no longer afford the payments. It’s the alternative to involuntary car repossession, when a repo company shows up unannounced, usually at the worst possible time, to take your car away.

Surrendering a car voluntarily gives you more power over the process, though it doesn’t erase the debt. Instead of waiting for the embarrassment and chaos of forced repossession, you make the call, set the date, and hand the car over on your terms.

Why Would Someone Voluntarily Give Up Their Car?

If we are being real, we know that nobody wants to give up their car. You car is your freedom, your commute, and maybe even your lifeline. But if this car is wrecking your finances, the benefits of voluntary repossession may outweigh the heartbreak. Let us look at why some people go through this route:

1. To Avoid Extra Fees

When your lender sends a tow truck to take your car, the costs don’t stop there. You’ll likely be hit with repossession fees, storage costs, and more. By surrendering the car yourself, you might avoid some of those extra charges.

2. To Maintain a Bit of Dignity

Your car being taken away might seem emotionally jarring. It is embarrassing, gives you all that stress and leaves you feeling deeply unsettled. Voluntary surrender of vehicle at the very least gives you time to clean out your car and the power to say your last goodbye avoiding the public spectacle.

3. To Take Responsibility

If you are taking an initiative, it might show the lender that you are handling the situation in a responsible way. This could open the door for better negotiations with the loyalty car dealership on what you’ll owe in the long run or at least help prevent things from going down a spiral. Especially if you’re making a voluntary repossession with no late payments, it could reflect positively on you down the line maybe even when starting a car dealership or re-entering the credit market for a new vehicle.

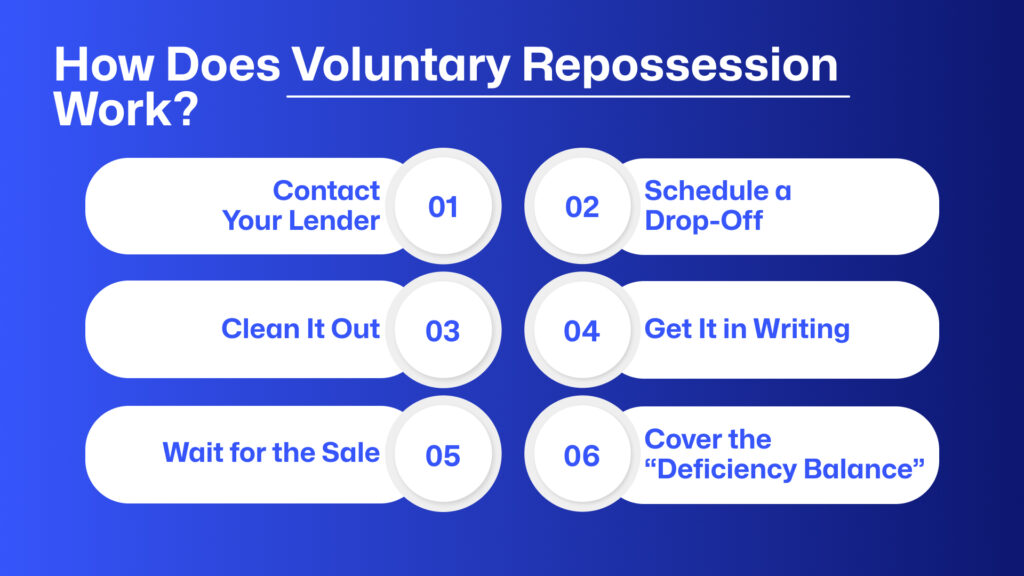

How Does Voluntary Repossession Work?

It’s not as complicated as you might think. Here’s how the process typically goes:

- Contact Your Lender: Call and explain that you can’t make the payments and are tell them about your decision of voluntary repossession of a vehicle.

- Schedule a Drop-Off: You’ll set a time and place to return the vehicle. Some lenders may even come get it.

- Clean It Out: Remove all personal belongings. It’s easy to forget things like garage door openers, paperwork, or sunglasses.

- Get It in Writing: Record the date, time, and the person you gave the car for the voluntary surrender of vehicle. Trust us, this can come in handy later.

- Wait for the Sale: The lender will sell the car, often at auction, and you’ll get a notice telling you how much it sold for.

- Cover the “Deficiency Balance”: If your car sells for less than what you owe, you’re still on the hook for the difference. This is called the deficiency balance.

Example:

Let’s say for example that you owe the lender $12,000 and the lender sells the car for $8,000. That doesn’t mean you are off the hook, you still owe the remaining $4,000 plus any late fees, interest, or collection costs that might have piled up.

Pros and Cons of Voluntary Repossession

The Upside:

- You’re in control. You get to choose when and where the car is returned.

- You avoid the repo drama. No surprise visits from the tow truck in the middle of the night.

- Potentially lower fees. Voluntary surrender may save you from some of the expenses that come with forced repossession.

- You can prepare emotionally. Saying goodbye is never easy, but at least you get the chance to do it on your own terms.

The Downside:

- You still owe money: If the sale doesn’t cover your full loan amount, you’re still responsible for the remainder.

- Voluntary Repossession Credit Impact: It affects your credit. Just like a regular repo, it’ll be marked on your credit report and stay there for seven years.

- It can lead to collections: If you can’t pay the deficiency balance, the lender might send the debt to a collection agency or take legal action.

How Voluntary Repossession Affects Your Credit

This part’s unavoidable: your credit will take a hit.

Even though you gave the car back willingly, lenders still report it as a repossession. It tells future creditors that you didn’t stick to your payment terms. It will likely stay on your credit report for seven years from the date you first missed a payment. The voluntary repossession credit impact is real.

That said, some lenders might look at a voluntary surrender more favorably than a forced repossession. It shows you tried to handle things responsibly, which could help a little if you’re applying for loans in the future.

What Happens When a Borrower Dies or Becomes Incapacitated

If a borrower passes away or becomes unable to make decisions, the car loan doesn’t just disappear. It becomes part of their estate if case of voluntary repossession of car after death.

If the estate doesn’t have enough money to pay the loan or if no one wants to take over the vehicle, voluntary repossession is a common solution. Here’s how that works:

- The executor contacts the lender and arranges for the car to be returned.

- The vehicle is sold, and any unpaid balance becomes part of the estate’s responsibility.

- The repo still goes on the borrower’s credit report, but in this case, that often has limited long-term consequences.

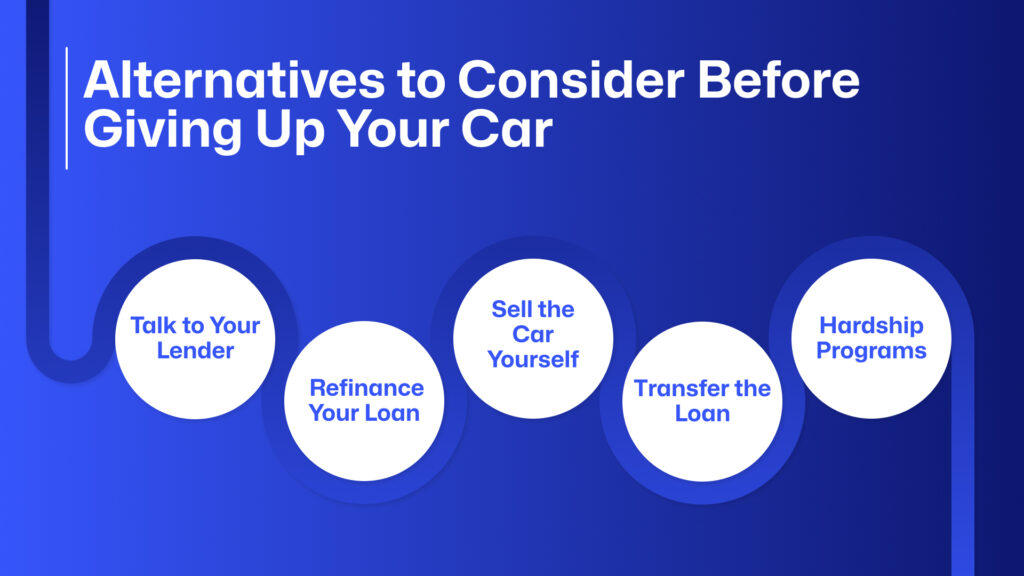

Alternatives to Consider Before Giving Up Your Car

Surrendering your car might feel like the only way out, but it isn’t always your best or only option. Let’s explore a few alternatives:

1. Talk to Your Lender

Before you default, call your lender. Many lenders offer temporary relief options like deferment, forbearance, or modified payments, especially if you’re facing hardship.

2. Refinance Your Loan

If your credit is still in decent shape, refinancing could help lower your monthly payment by getting a lower interest rate or spreading the loan out over a longer term.

3. Sell the Car Yourself

If your car is worth more than what you owe or even close to it, you might be able to sell it, pay off the loan, and walk away clean.

4. Transfer the Loan

Some lenders allow loan transfers. If you have a trusted friend or family member who’s willing to take over the payments, this might be an option.

5. Hardship Programs

Ask your lender if they offer hardship programs. These are sometimes available if you’ve experienced job loss, medical emergencies, or other major life changes.

A Last Resort: Bankruptcy

If things are truly out of hand, bankruptcy might be worth considering.

- Chapter 7 Bankruptcy: This allows you to give up the car and discharge the loan along with other unsecured debts like credit cards or medical bills.

- Chapter 13 Bankruptcy: This gives you the chance to restructure your debt. If you’ve had the car for more than 2.5 years, you might be able to reduce the loan amount to the car’s current market value.

Before taking this route, talk to a qualified bankruptcy attorney. They’ll help you weigh all your options and choose the best path based on your situation.

Final Thoughts: Don’t Do It Alone

Voluntary repossession is a serious decision and comes with its own share of consequences. But it is never the end. It can be a stepping stone towards rebuilding your financial life, especially if you approach it with your eyes wide open. Whether you’re dealing with car buying stress, financial hardship, or dreaming about starting a car dealership down the road, this is just one part of your journey.

Before you hand over the keys or surrender car to lender, ask yourself:

- Have I talked to my lender?

- Have I explored every other option?

- Do I know how this will impact my credit and finances?

- Have I spoken to a financial advisor or bankruptcy attorney?

No matter what road you go down on, just know that you are not alone. Millions of people have faced something similar but the most important thing is to take action and not ignore the problem altogether.

And when it’s time to buy again? Consider a more affordable car, maybe something used. Or even save up and pay with cash. It’s not always easy but it’s possible.